M.M. Tirion

At this evening’s village board meeting, the public has an opportunity to input comments on the Mayor’s proposed budget for fiscal year 2023-2024 (see: vi.potsdam.ny.us/content/News ). It may be of interest to bring attention to two trends.

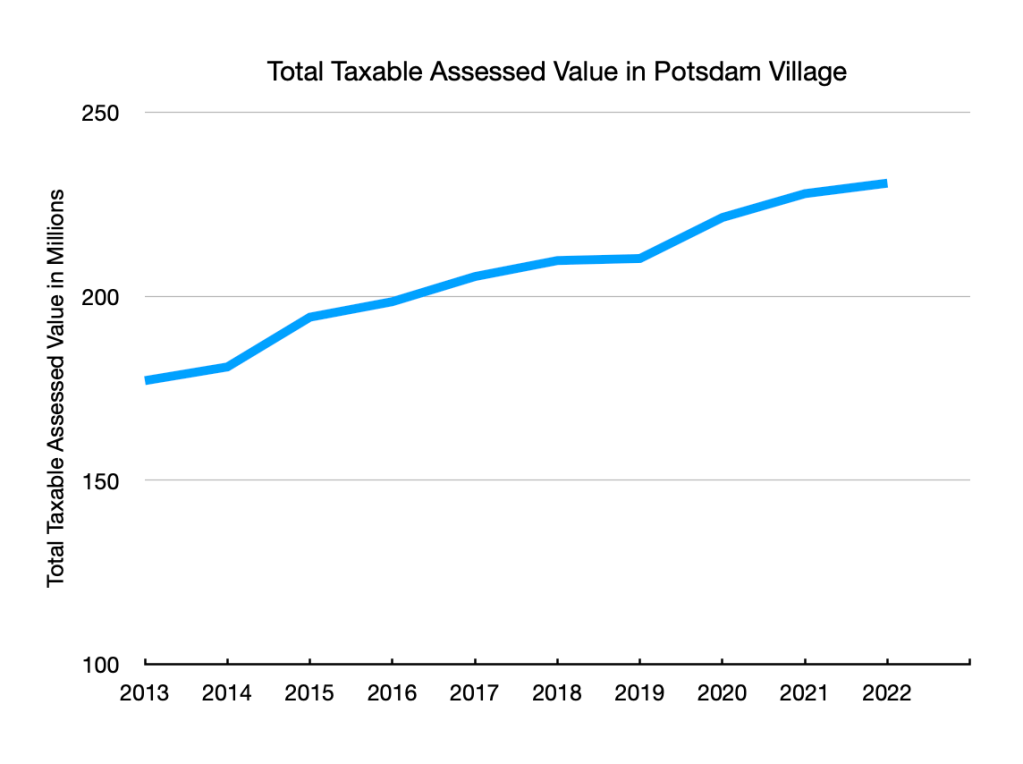

The first plot shows the total taxable assessed value of all nonprofit-properties in the village of Potsdam, as reported by NY’s Office of the State Comptroller’s Open Book Local Government, available online. In 2013 the total taxable assessed value in the village was $177 million, and has grown by an average of 3.0% to $231 million in 2022.

This means that in 2022, every $1.00 per $1000-of-property-value raised $231,000 revenue for the village. For an actual tax rate of near $18.00, the revenue was $4.158 million.

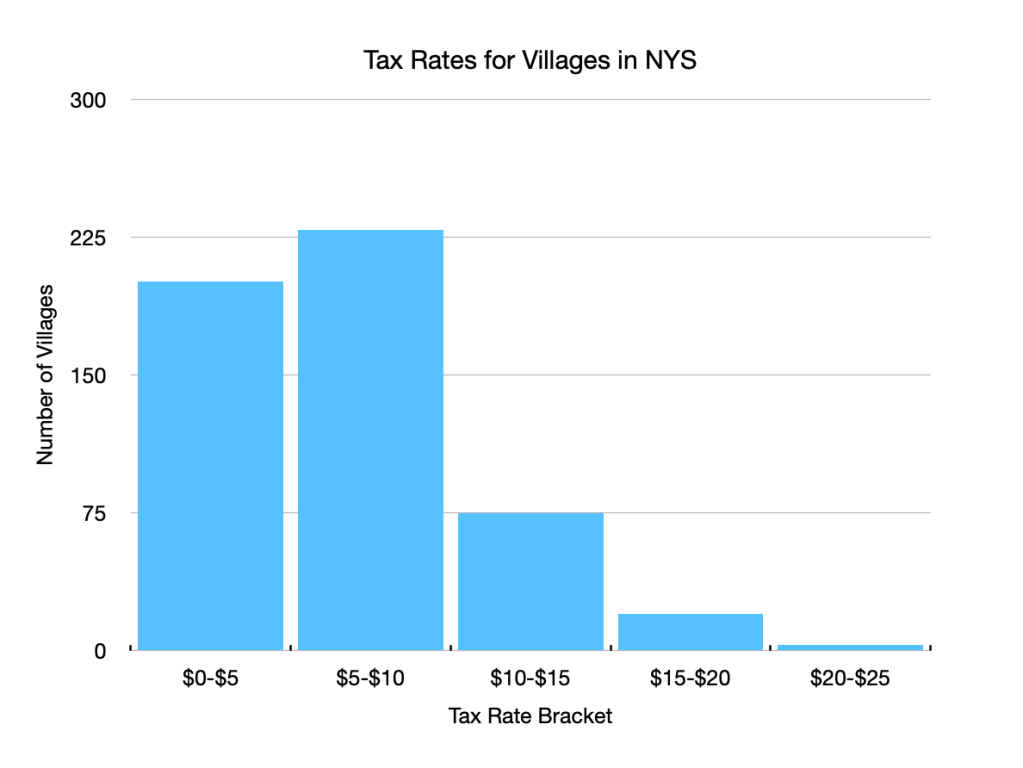

How does the village’s tax rate compare to the other villages in New York? The second graphic gives an impression of village tax rates in NY: The average tax rate for all 534 villages is $6.65 per $1000-of-property-value, with a median of $5.89/$1000. In 2022 Potsdam village, with a tax rate of $17.62, ranked as the 7th most expensive in New York.

For comparison, Ogdensburg’s city-tax rate was $15.89/$1000 in 2022, and Massena’s $16.35/$1000. The highest village tax rate is held by the village of Herkimer, at $21.21/$1000.

Is this justified? How does Potsdam’s total taxable assessed value (TAV) of $231 million compare to other villages? Is Potsdam’s tax base skewed due to the nontaxable universities, medical centers, and other nonprofits in the village? In fact while 80 villages obtain an enviable TAV of over $1 billion, the village of Potsdam has a higher TAV than 341 villages. Potsdam, even without contribution of its nonprofits, remains a rich municipality, based on comparative property values.

So why is the tax rate the 7th highest in the state? Perhaps it helps to remember that for each tax-rate dollar of taxable assessed value, the village raises $231,000 (in 2022). Looking in the FY23-24 proposed budget, I see that the hydro budget expense this year is expected to be $568,446. In FY22-23 the east and west dams generated $76,938.65 in revenue for the village. If the nearly $500,000 unpaid balance is to be covered by property taxes, this would add over $2.00 to the property tax rate (ie without the hydrofund, we could have a tax rate of $16/$1000 instead of $18/$1000). In fact, the General Fund receives about 64% of its revenues from property taxes and another roughly 22% from sales taxes, and the TAV is expected to increase by 3% to $337 million at the end of FY24, implying that the portion of the tax-rate needed to cover the hydro fund is $1.12/$1000.

Perhaps the thought that every $1.00 of the property tax-rate increases the village’s income by $330,000 motivates a more careful perusal of the Mayor’s proposed budget.