The village board has been asked to ok salary increases for several employees. I do not doubt the value of staff’s contributions in keeping the village operational. It seems prudent however to see whether the percentage of our property tax revenue going towards salaries is increasing or decreasing over time. Salaries increase at least 2% every year by union rules, as I understand, but property tax revenue also increases as the net worth of land and buildings typically increases every year. As the number of employees also varies, where the balance between salaries and revenue lies is unclear. I therefore asked staff to please provide graphics to illustrate how the share of property taxes going towards salaries has changed over the past 5 years. Unfortunately, staff is swamped paying & recording bills, balancing & reconciling accounts and providing endless reams of data to the external auditor.

As municipal budgets are open access, I decided to download and decipher the salary data manually, from online pdf budget reports rather than from the more convenient Excel-type budget worksheets that staff presumably have access to.

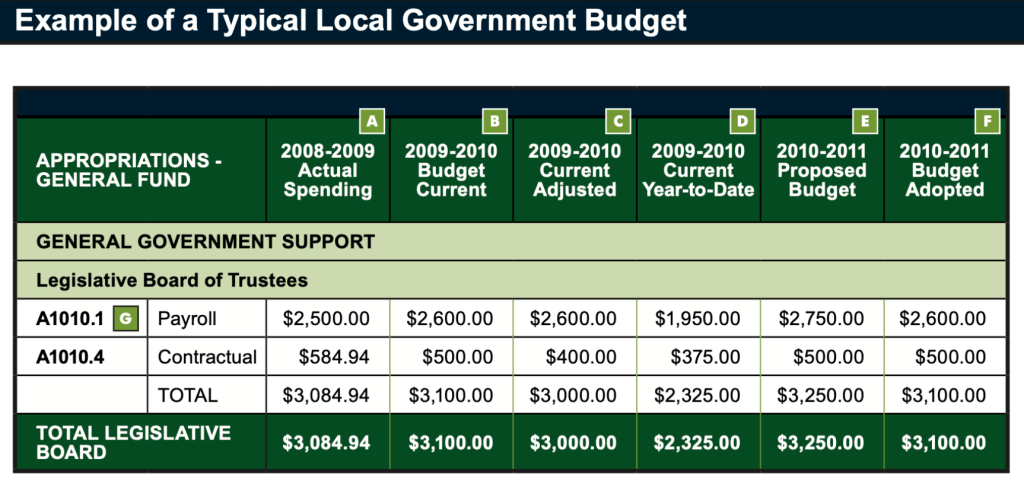

In budget reports, actual amounts of money spent in previous years are compared with on-going expenses in the current year to make forecasts for next year’s monetary needs. Realistic forecasts of future spending, termed appropriations, permit municipalities to set appropriate tax rates.

And indeed, these accounting basics were maintained by the village of Potsdam. Until 2018.

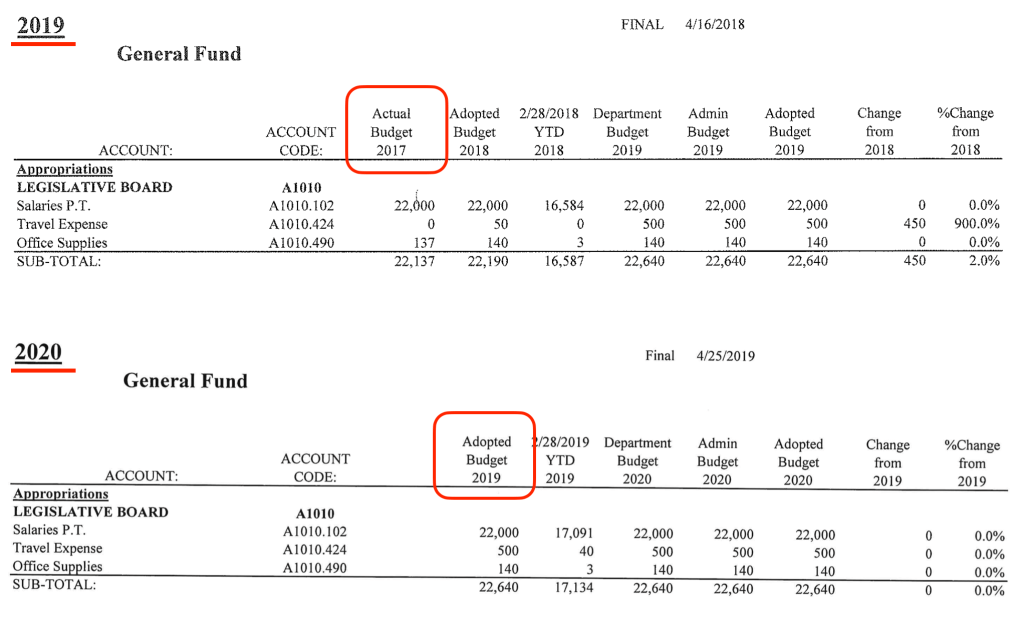

Before 2019, as you can see in the screenshot of the first items in the Budget Report below, the column “Actual Budget 2017” reported the actual, to the dollar, expenditures for all items and all departments. So during the budget preparation time (April) for fiscal year 2018-2019, Potsdam’s budget report presented the board with the actual expenses for each item during the previous budget year (2016-2017) in the first Budget column. The next column presented how much was allocated for each item in the then-current budget year (2017-2018), followed by the year-to-date (YTD) expenses as of 2/28/2018, to provide a sense of whether each budget item remains in line with expectations. The remaining columns report on the future budget (2018-2019) requests: a column presenting the amounts requested by each department (police, parks, DPW, code enforcement etc), followed by a column presenting the administration’s counter-offer and then a final, board approved “adopted budget” column. In order to draw attention to any aberrations, the final two columns list the changes in future spending requests compared to current amounts, both in terms of dollar amounts as well as a percentage change. Any items with big changes can be quickly detected and discussed.

But note what happened in the following budget of 2020. The first column, reporting the actual expenses of the previous year, is absent, blank. And has remained so: Are Actual Budget expenditures reported in

FY 2016-2017: Yes

FY 2017-2018: No

FY 2018-2019: No

FY 2019-2020: No

FY 2020-2021: No

FY 2021-2022: No

FY 2022-2023: No

FY 2023-2024: ?

Actual expenditures have not been reported on for six budget cycles! So while I, as Trustee, have both the time and wish to analyze our spending patterns, I cannot. I have no data to make plots comparing actual expenses across the years and comparing them to actual revenues (which are available). Is this ok?

From NYOSC Local Government Management Guide: Fiscal Oversight Responsibilities of the Governing Board:

Once the financial course has been set through the adoption of key policies and plans, board members have the equally important task of keeping local government operations on course. This oversight responsibility requires continued diligence. Governing board members should compare actual results to plans, policies, and directives.

It is essential that the governing board receives regular financial reports from the CFO, treasurer, or business manager to fulfill its responsibility of monitoring financial operations. Generally, corrective action is easier to initiate when the need is identified early. Interim reports should provide the board with timely information on such issues as: financial position, results of operations, budget status, policy compliance, service or project costs, performance measures, and legal compliance matters.

To help meet these objectives, the CFO, designated budget officer, and department heads should regularly monitor actual revenues and expenditures and report these figures to the governing board. Budget status reports provide the governing board and other decision makers with information about year-to-date revenues and expenditures compared to budget estimates. At a minimum, these reports should identify unfavorable variances that require timely budget amendments

Potsdam trustees have not received regular financial reports, and so I am unable to fulfill my obligations as trustee. I am unable to monitor spending patterns and report back to residents whether the village’s financial standing can absorb requested salary increases and other budget modifications, or comment more generally on how sound village finances seem to be.

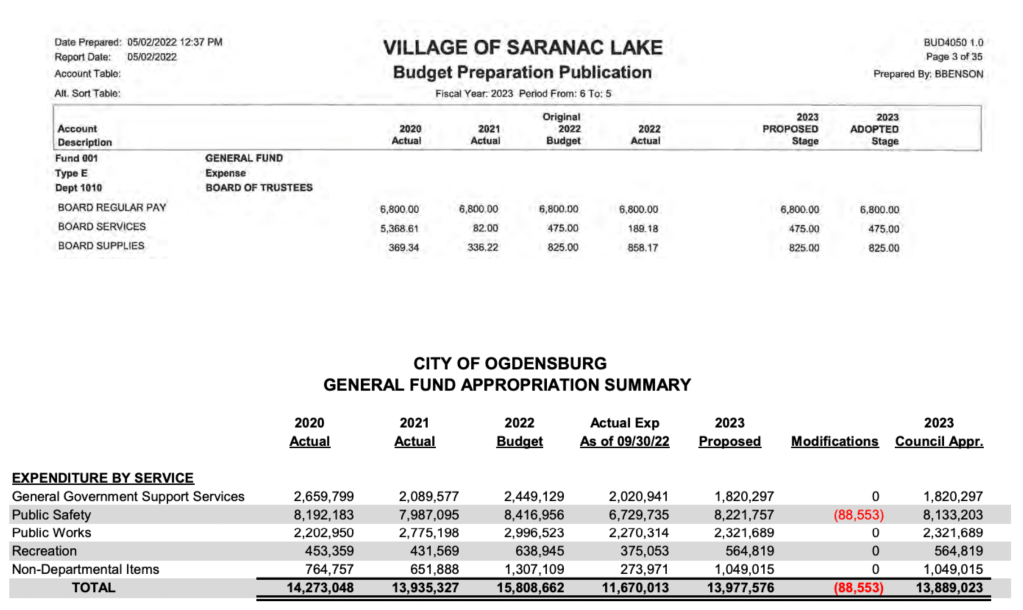

Do neighboring municipalities provide the mandated expense information? Two nearby, similar GDP-sized municipalities, the Village of Saranac Lake and the City of Ogdensburg, provide online budget reports going back many years and include the actual expenses for not one, but two earlier budget years. In the screenshot below, for example, for FY2022-23, the actual expenditures of both FY 2020-21 as well as FY 2021-22 are reported.

I do not know how to correct this situation. Requests to amend this omission going forward have not been acknowledged. I worry that this error permits sizable budget indiscretions that will not be detectable. As I understand due diligence, I will refrain from accepting future budget modifications without further data.