Village homeowners pay taxes that people living in the Town do not:

• A tax based on assessed property value, termed the village tax

• Taxes for the use of water and sewer, termed water and sewer rents

In fiscal year 2022-2023, the village received $4.6 million from property taxes and $3.2 million from water and sewer rents. Together these accounted for 62% of the village’s operating budget of $12.6 million. (A big chunk of the remaining revenue comes from sales-tax revenue.)

As property tax levies are independent of income, they are considered regressive, not progressive. However, insofar as higher income earners live in properties with higher property values, they somewhat scale with income. This is not true for the sewer and water taxes. Everyone pays the same for those, regardless of income and regardless of the total assessed value of a property. This led me to wonder how property values are distributed in the village.

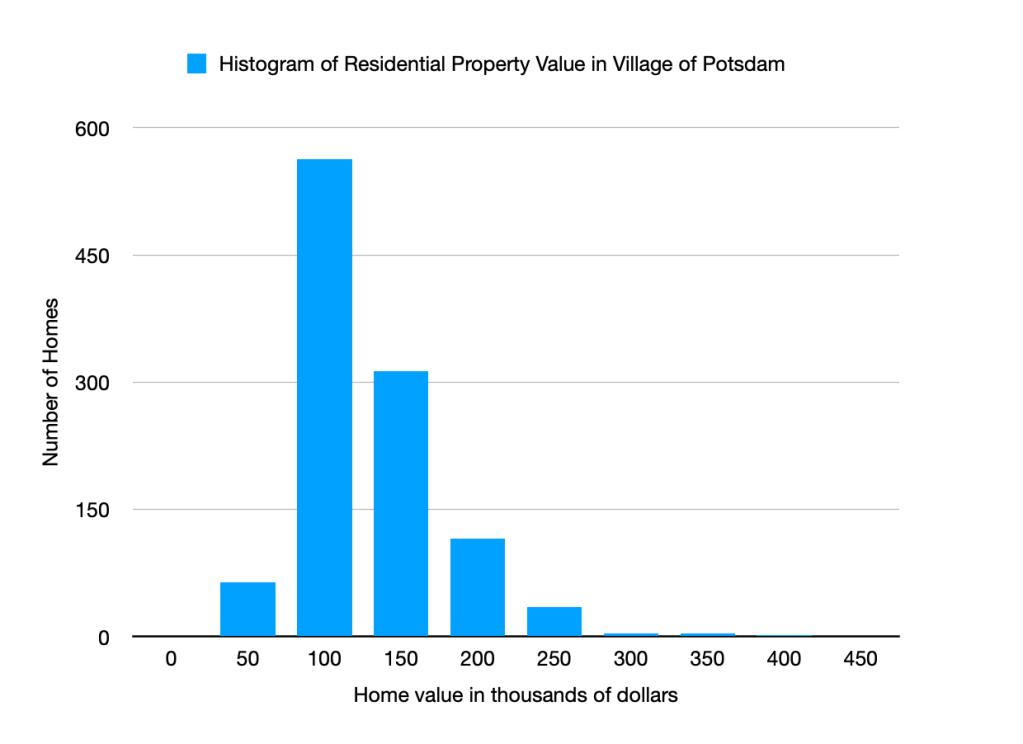

I asked the Town Assessor for a listing of all residential property values and made the following histogram. There are 1,102 taxable residential parcels in the village, ranging in value from $9,300 to $419,100. The average residential property value is $104,259 while the median home value (the 551st entry of the listing of lowest to highest of all 1,102 entries) is $91,400.

A home with a total assessed value of $75,000 paid $1,371 in village taxes in 2022-2023. If this home stood idle and used no water, the homeowner would still pay $317 in combined water and sewer taxes, which is nearly 1/4 of the village tax amount. In contrast, a home with an assessed value of $220,000 pays $4023 in village taxes and would pay the same $317 for water and sewer rents if no water was used, which represents less than 8% of that homeowner’s village tax.

As trustee, I am asked to supervise the tax levies on village residents. Are the water and the sewer taxes effective and equitable? The taxes were far more equitable pre-2018 when the water and sewer rents were tied to water-usage amounts. Due to the large number of snowbirders and empty apartments, the village often suffered unexpected revenue shortfalls, so the administrator would say the pre-2018 tax structure was not effective. Currently, post-2018, the income stream is stable and effective in that sense, but the tax burden is not distributed equitably. Homeowners who use 5 EDU worth of water, because they empty and fill swimming pools or hot tubs several times a year, pay the same fixed fee as homeowners who use 0.5 EDU worth of water. People who conserve water pay for the profligate users.

Simultaneously, a different burden has been placed on apartment owners. One retiree explained to me that he could not make ends meet financially on his retirement savings and decided to rent out his second floor. This changed his home’s status from a “one-family year-round residence” to a “one-family year-round residence with accessory apartment” and resulted in a 2 EDU-tax for his water and sewer rents (instead of the 1 EDU tax for a one-family residences like mine). Even when his upstairs is unrented, he must pay 2x$317 or $634 in sewer and water taxes annually: over 50% of his village tax. He has been lobbying for a reprieve on this tax burden since 2018.

An apartment complex with 100 units, like Meadow East, uses about 500,000 gallons of water per quarter, or about 2 million gallons per year. Pre-2018 these 2 million gallons cost the owner of the complex $32,040. Post-2018, these same 2 million gallons cost the owner $48,466, a $16,426 or 50% increase. If apartment complexes are set up so each unit is individually metered, as at Swan Landing, this cost is distributed to every renter. In older complexes like Meadow East the apartments are not individually metered, and the owner pays the entire bill. Whether renting out a portion of one’s home as an accessory unit or renting a hundred apartments in a complex, each empty unit costs the owner $317 per year for the water and sewer tax.

In order to create effective, steady income streams for the water and sewer departments, some type of EDU-based billing will be necessary. However, the cost burden should be distributed more equitably so that private and commercial residences do not carry a disproportionate share of the costs.

One thought on “Equity with Taxation”