The village’s budget year ends on 31 May, 2024. As we approach the end of this budget year, the Treasurer, Department Heads and Mayor are busy developing a new budget for 1 June 2024 – 31 May 2025. How does that work?

Village operations are funded by different sources. All operations that are funded by property taxes and sales taxes are paid from a fund called the General Fund. The General Fund funds the police department, the department of public works (which maintains our infrastructure including underground pipes and roads), support for emergency services (fire & EMS), parks and recreation, economic development, clerical services, health insurance, salaries, pension payments, computer and software support, the hydroelectric department (unfortunately) and more. What operations does the General Fund not fund? Only the water and the waste-water (sewer) departments. Both the water and the sewer departments have their own funds, called the Water Fund and the Sewer Fund, that receive their revenues from water-use fees and sewer-use fees (from the quarterly water/sewer/trash bills).

The game plan for each of these 3 funds (General, Water and Sewer) is identical: Match expenses to revenues. The process starts when Department Heads, looking at prior year expenses and extrapolating future costs, obtain their best estimate for next year’s expenses, and request a certain level of funding. After all Department Heads have submitted funding requests for the following year, the Treasurer compares the sum of requests to the expected level of revenue for each fund.

For example, the Treasurer receives total expense requests of $7 million for all General Fund operations. The county provides an estimate of $2 million for next year’s sales tax revenue, based on current and past sales. So that means that the Treasurer needs to set our property-tax rate to generate $5 million. Let’s say the Assessor tells us that the total taxable property value in the village is $200 million. To raise $5 million from property taxes, therefore, we’d have to set a tax rate of $25 for every thousand dollars of property value.

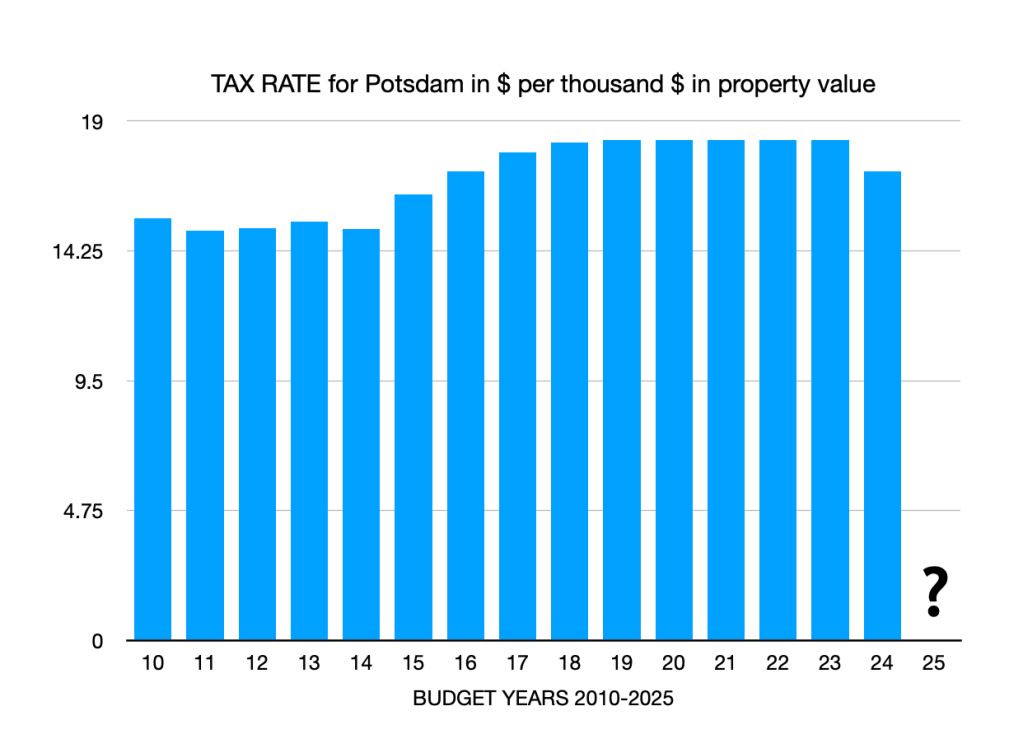

That tax rate is much higher than our current tax rate (see figure) and unacceptable on many levels. And so negotiations begin: to lower expense requests; to examine whether we can withdraw funds from savings to offset some of the expenses; or to find alternative revenue streams, such as from parking meters. Ultimately, the aim is to not raise the property-tax rate from last year, and hope that an increase in overall taxable property value (because of new construction for example) provides any needed boost in property tax revenue.

For those interested in the actual numbers: This year the General Fund expense requests totaled $7.5 million (the requested amount for next year’s budget will soon be released). The village is projected to receive $1.8 million in sales tax revenue this budget year, and the Assessor reports that the total taxable property value in the village is currently $223 million. The entire “preliminary” budget for next year will become available on the village website: https://vi.potsdam.ny.us/category/news/budgets/