Yesterday, village Trustees received the Preliminary Budget for 2024-2025. The Budget Report is freely available at the village website: vi.potsdam.ny.us/treasurer

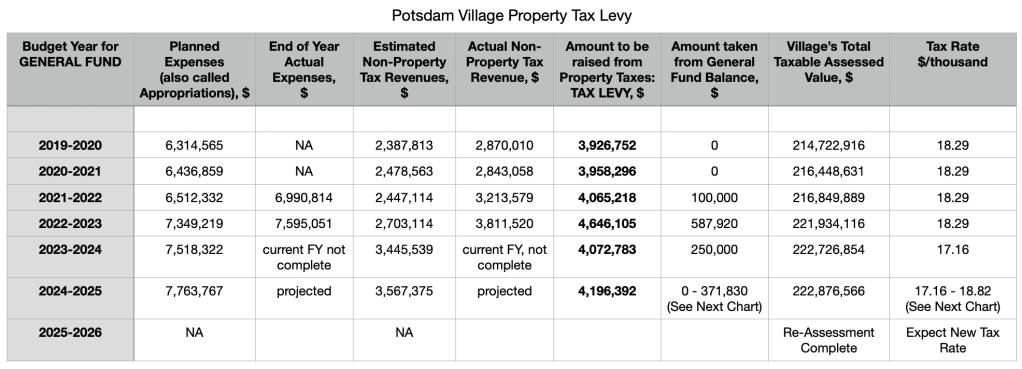

Requisition requests (“Planned Expenses”) for the General Fund amount to $7.8 million for fiscal year 2024-2025, an increase of a quarter million dollars, or 3%, over the previous year’s requisition requests (see chart below). Non-property-tax revenue (primarily sales tax revenue, plus interest earned on savings and income from fees) is estimated to be $3.4 million. Hence the Tax Levy on property, the difference of those two, is $4.2 million, an increase of $124,000 or 3% over the previous year.

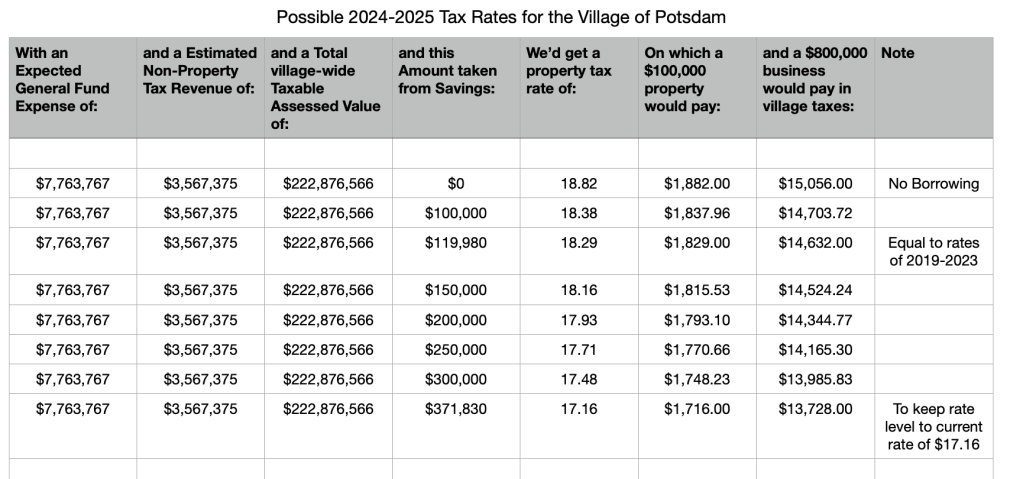

What will be the resultant property-tax rate? Will it be $17.16 per thousand dollars in property value, like last year, or will it be $18.29 as during the years 2019-2023, or will it be somewhere in between? That depends on how much the Administration pulls out of savings. Prior to budget year 2021-2022, I can find no instances of money being appropriated from the General Fund balance sheet in order to lower the tax rate (see column “Amount taken from General Fund Balance” above). However, in budget year 2021-2022 a new $3 million loan for a East Hydroelectric Plant rehabilitation became active, requiring either increased tax rates or withdrawals from the General Fund balance sheet.

As you see in the chart below for the next budget year, if we do not pull money from savings, our tax rate would be a prohibitive $18.82 per thousand dollars in property value. However, to keep the tax rate at the current level of $17.16, the Administration would need to pull $372,000 out of savings, which also seems imprudent, as the Board does not know the current Fund Balance in the General Fund.

On May 31, 2022 the General Fund held a generous Fund Balance of $4.7 million. The board does not know the General Fund balance since that date, partly because all village revenues, whether into the General Fund, the Water Fund, the Sewer Fund, or from State and Federal grants, goes to the same investment vehicle, and separating which fund held how much is currently only deciphered by our external auditor, not in-house.

As the board begins to deliberate where to set the next year’s property tax rate, it should be noted that (1) the total Planned Expenses, or “Appropriations” at the start of a budget year typically run short of the Actual Expenses at the end of the budget year (see top chart); and (2) Over-spending by the General Fund in recent years has been offset by greater than planned revenues to the General Fund, thanks in large part to increased sales tax revenues and generous interest earned on savings. But both items invite caution: State Comptroller Thomas DiNapoli wrote in a 2/21/2024 press release: “Year-over-year growth in local sales tax collections has slowed significantly, with a nearly flat increase this January compared to last year…With overall growth having moderated over the course of 2023, local officials should remain cautious in their sales tax revenue projections for 2024.” And secondly, if the Administration depletes Fund Balances, the village loses a valuable income stream from interest earned on savings: interest earned the General Fund $250,000 in revenue last year, for example.