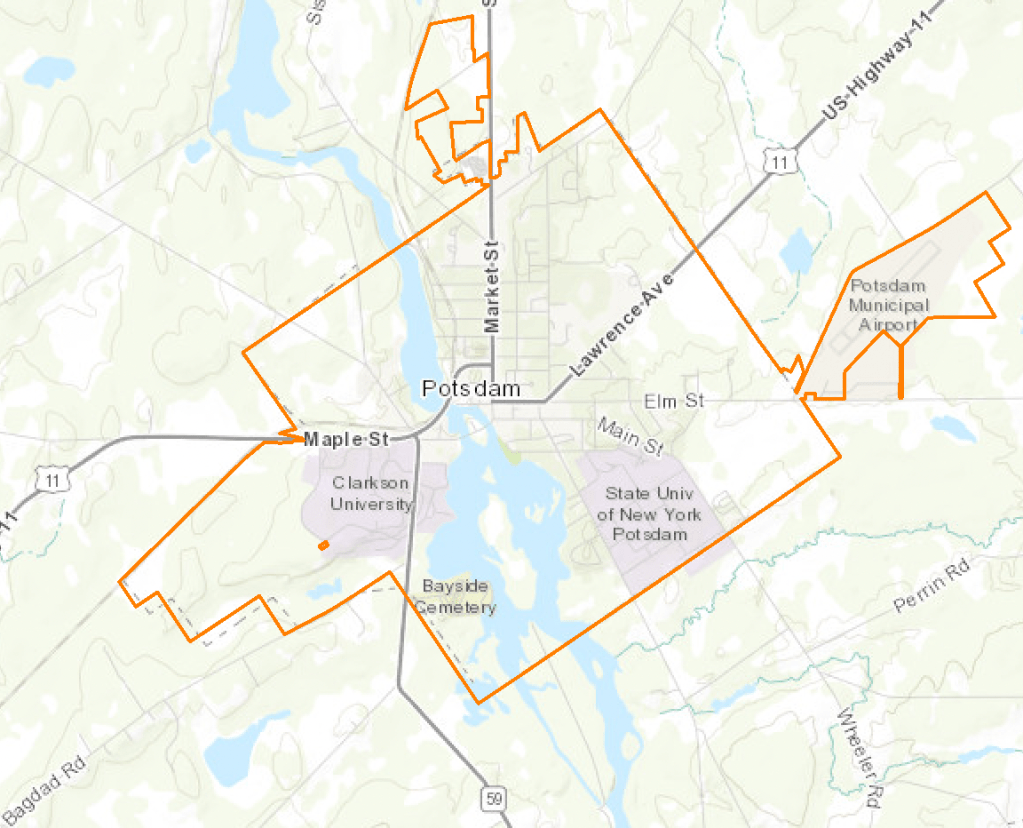

The village boundary was once a square 2 miles by 2 miles, encompassing 2,560 acres. Additional lots have been incorporated: Clarkson University added 415 acres around the water tower trail. The Price Chopper, Lowe’s and the Mayfield apartment lots added another 131 acres around outer Market St. The airfield beyond Hatch Rd. added a further 256 acres. So the village boundary currently encompasses a bit over 3,100 acres.

How much of this land is in private hands and taxable?

The river removes 316 acres from development.

What other properties are tax-exempt? Clarkson University’s 640 acres. NY State’s 240 acres of the SUNY Potsdam campus. The Potsdam village municipality owns the 80 acres of the 3 Potsdam Central School District schools. Potsdam village altogether owns 313 acres (a large fraction of that being the airport). The Town of Potsdam owns about 15 acres of village land. Rochester Regional Health, between its Canton Potsdam Hospital Leroy St campus as well as its Lawrence Ave campus, owns 36 acres.

Other nonprofits with significant landholdings include Bayside Cemetery Association, with over over 71 acres, the Potsdam Housing Authority with 18.7 acres at Evergreen Park on the Racquette Rd and the Midtown Apartments with 2.6 acres. Mayfield Apartments sit on 13 acres. Other nonprofits with smaller holdings include The Church of Latter Day Saints with nearly 4 acres, our two Baptist churches with a bit over 8 acres and Trinity on Fall Island with 3.2 acres. NYSUT occupies 2 acres. When you sum the land owned by these various nonprofits, it totals to nearly 1,450 acres.

How many acres do our roadways occupy? Analyses indicate that roads take up between 18-30% of urban land. If we assume a low 15% of land to be taken up by roads on the original 2 by 2 square miles, this subtracts another 384 acres from development.

How many acres of land remain that are taxable? Of the 3100 acres, no more than 954 acres are currently taxable. Or slightly less than 31%.

If we prefer to look at the actual value of the lots, rather than acreage: The total assessed value of taxable lots (tax rolls 1, 5, 6 and 7) in FY23 came to $223 million. The total assessed value of all nonprofits came to $459M. So the fraction of the total assessed value that contributes to the tax base is 223/(223+459)=33%. That this fraction is slightly larger than the acreage fraction is perhaps due to the fact that roadways are not assigned assessed values.

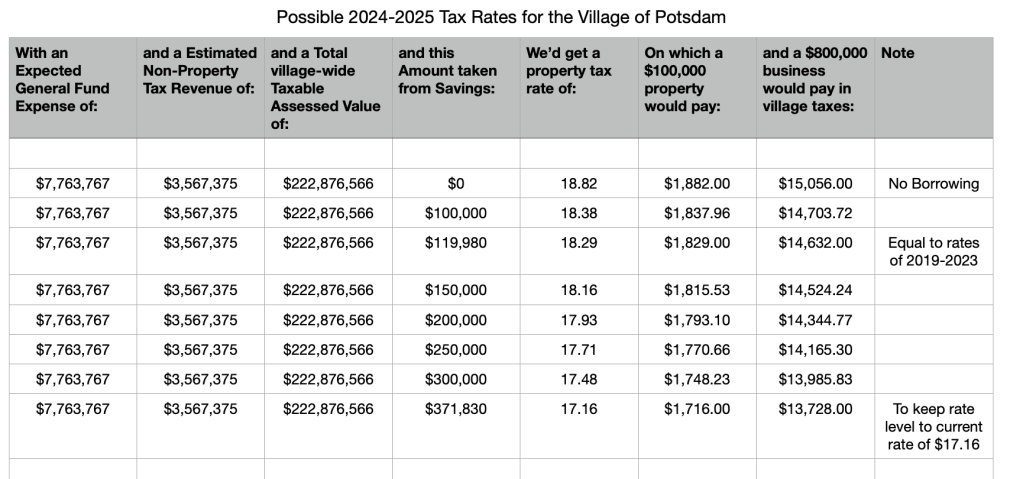

These numbers, while stable, are not fixed. The 5-member village board of Trustees can vote to classify and re-classify the Property Class Code of every parcel in the municipality. Places of worship may be established, federal, state or county-supported low-income housing can be created, hospital and university campuses may expand and the town/village line may occasionally be redrawn (as for the Airport Diner recently).

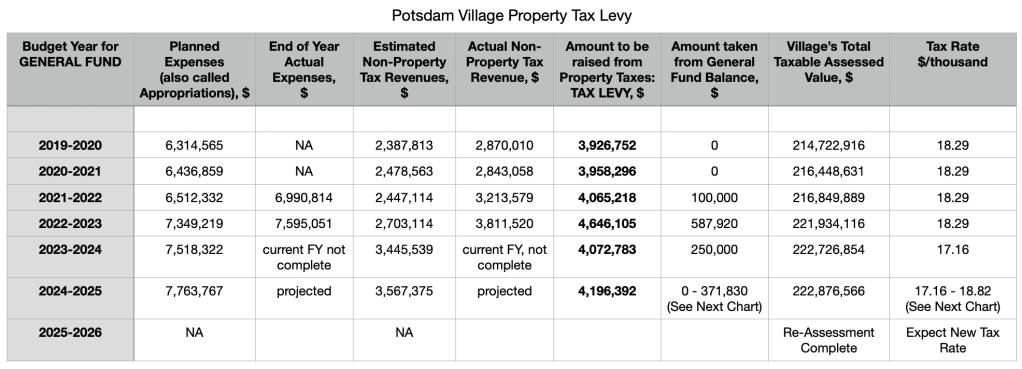

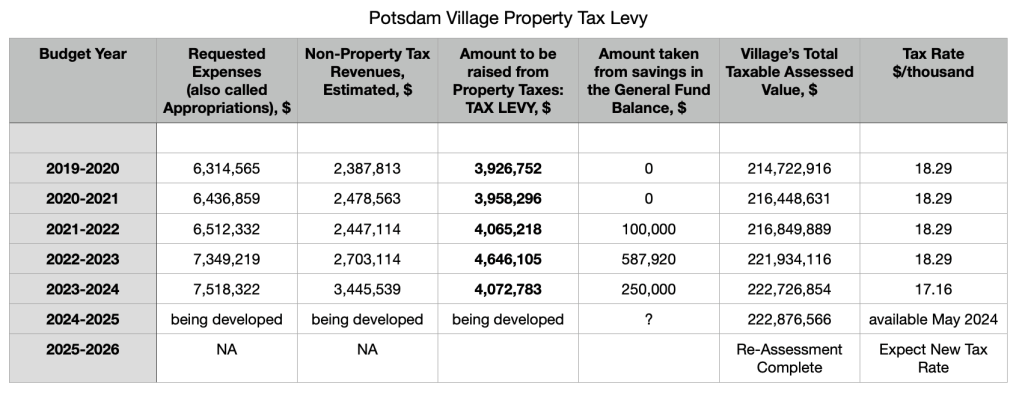

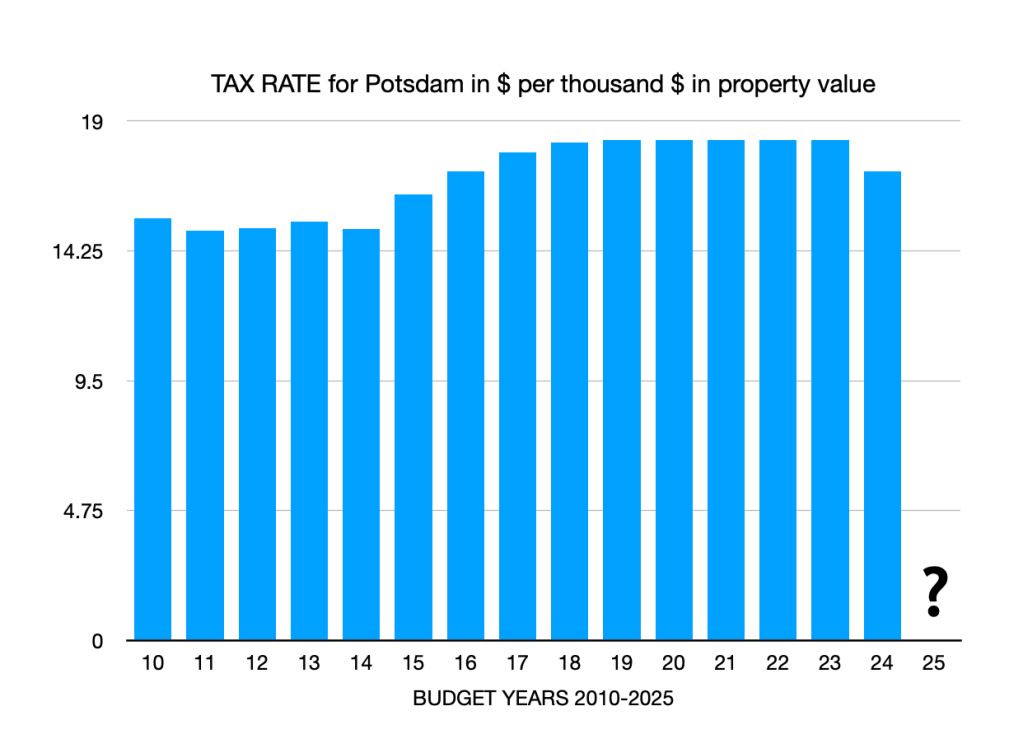

Nonprofits provide valuable and laudable services that appeal to visitors and residents alike. Without our famous landmarks, Potsdam would be a very different place. But the nonprofits, in turn, require a robust tax base to finance the departments of public works, police, civic center, recreation, as well as debt payments, salaries, health insurance and retirement benefits for current and former employees and their dependents. Given that our municipality can obtain no tax revenue from more than 2100 of our 3100 acres, should the administration continue to cede parcels to the nonprofit sector? The annual ask (appropriations) of the village’s General Fund went from $6.5 million in fiscal year 2022 to $7.5 million in 2024, a 15% increase. Sales tax revenue has also increased, but not enough to keep our tax rate level. Is it therefore in the residents’ interest to cede land via sale (as we did with a portion of Cottage St) or via permanent easement of residential land (as was just done with the 2 acre lot at the end of Clough St)? Unless a reliable alternative revenue source for the General Fund is identified, I would advise caution in relinquishing more land to the wholly exempt section of our tax rolls.