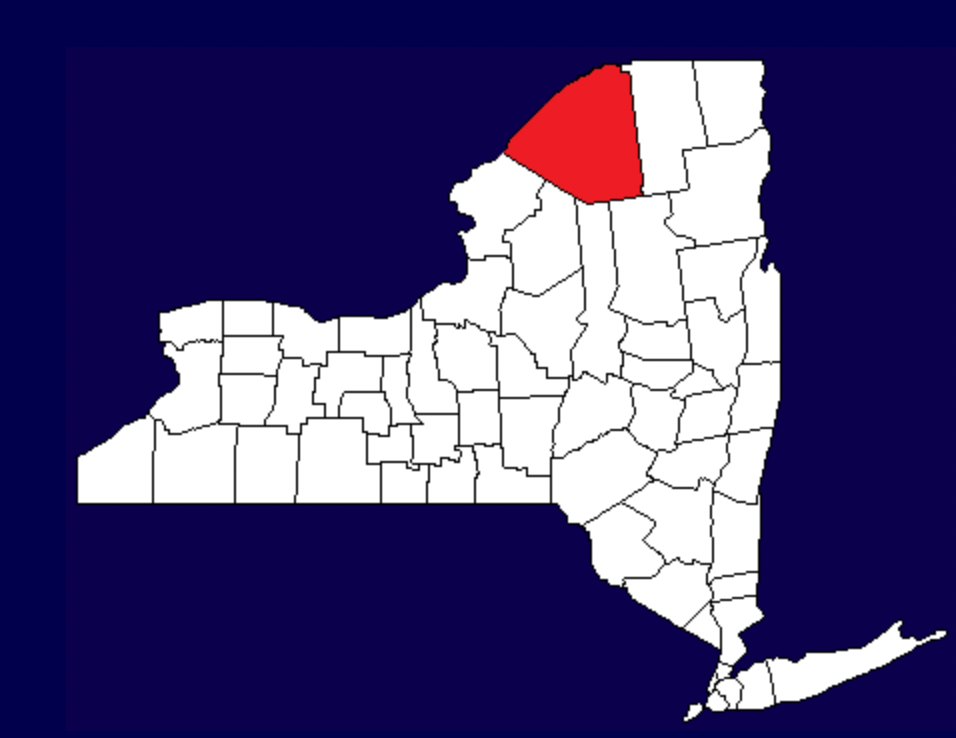

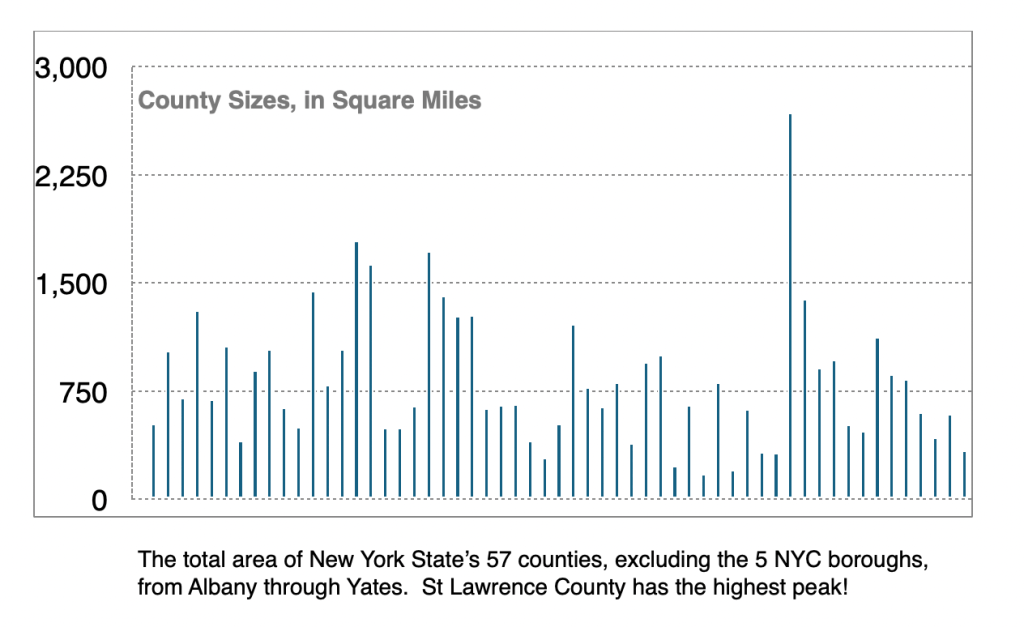

The village is currently involved with numerous projects in various places in the pipeline from conception to engineering & environmental reports to execution. Projects still in the early, planning stages can be adjusted and affected by public input/ideas/suggestions/concerns: these can be shared directly with staff and board members during board meetings or communicated via emails and/or letters to the editor.

Here is a partial list of projects, in random order & filtered thru my limited grasp of particulars:

Downtown StreetScape Enhancement A re-design of sidewalks & crosswalks in the downtown area, to improve overall appearance and appeal. Design and funding complete; awaiting actual construction. Funded by NYS grant program (DRI)

Riverwalk Trail An attempt to create an inviting, continuous riverfront walking trail along the Sandstone Dr overpass to Garner Park and Raymond St, on to Market St and Maple St, and so back to Sandstone Dr. This project fits in naturally with the Munter Trail and will hopefully blend in with an eventual Garner Park to Fall Island Footbridge, described below. Design specifications and funding complete, awaiting actual construction. Funded by a NYS grant program (DRI)

Garner Park to Fall Island Footbridge An effort to replace an exposed and vulnerable cross-river sewer line with a secure line beneath a footbridge linking Garner Park to Fall Island. Preliminary designs complete, and efforts to secure funding for the engineering & environmental reports underway.

Skatepark An effort to site an in-ground skatepark on Fall Island at 19 Maple St. Funding by NYS DRI approved, but environmental remediation required, as this spot was once occupied by a gas station. This site may also face higher scrutiny due to its proximity to the river as well as sites listed on the National Register of Historic Places (Trinity Church as well as 17 Maple St)

Brooks St A new short roadway to link Depot St and Raymond St alongside the Potsdam Mall. Funded separately from the DRI projects mentioned above, this new roadway is an integral part for improved car and foot traffic behind the downtown portion of Market St. This project has obtained its requisite Environmental Impact Report and its design specifications are being finalized before construction can begin. Funding for the engineering & design specifications came from a Federal grant (NBRC).

Toilet for Ives Park This idea appeared in the 2013-2023 Potsdam Village Comprehensive Plan. Project nearly complete. Funding for construction came from the Federal American Rescue Plan (ARPA)

Boathouse for Ives Park Another concept being discussed is the construction of a boathouse on Ives Park. Boating enthusiasts would be able rent space to store their boats and non-boat owners could rent kayaks to paddle the Raquett, taking advantage of the handy boat launch already installed. The boathouse committee consists of 2 trustees and 3 residents who all enjoy paddling. This project is still in its early planning phase and welcomes comments from the public.

Lead Lateral Identification and Replacement Currently on-going, a federally as well as state mandated effort to identify and eliminate every trace of lead in our water pipes. Testing to ID all water lateral lines contaminated with lead is funded by a NYS grant (EFC)

Airport Improvement Efforts to lengthen and improve our runway and fencing around the municipal airport to permit larger carriers, including UPS and possibly commercial airlines, to land and take-off here. Design complete and construction due to start in summer of 2025. 90% of funding from Federal grants (FAA), the remainder (about $20,000 as I recall) from local property taxes

Safe Streets and Roads for All This addition to the village’s project list is an effort to obtain funding to improve roadways throughout the village. Part of this effort is in conjunction with the Town of Potsdam. Likely included in this effort would be redesigns of Rtes 11, 11b and 56 to improve both safety and visibility for pedestrian and bicycling usage. This project is still in its initial planning stage: funding is sought for an overall study.

Stormwater Drainage Improvement: An urgent new addition to the village’s ToDo list: An effort to identify funding opportunities for the design of large holding basins (small lakes essentially) upstream from downtown, to lessen the volume of stormwater into the downtown region during massive rain events. Two preliminary studies ID-ed locations for possibly 3 holding basins to protect low lying areas along the eastern shores of the Raquette river. New engineering report required; funding sources have recently been ID-ed but applications not yet written.

Pine St Flooding Engineering Reports to study and address flood risks on the western shore of the Raquette River have not yet been undertaken. A recent significant flood event on Pine St. occurred not due to heavy rains, but due to a beaver dam break. Multiple beaver dams exist on private land and present a danger to village- and private-landowner properties downhill. A redesign of flood waters flowing past properties along Pine St and to the Raquette River is needed, but not yet in the pipeline.

Inflow and Infiltration into Sewer Lines The sewer plant experiences significant threat of overflows during heavy rain events due to persistent inflow and infiltration of rain water into sewer lines during rain events. In addition to the threat of overflows at the sewer plant, I&I leads to the eruption of untreated sewage onto village properties when sewer manhole covers erupt during rain events. An Engineering Report describing the I&I problem facing Potsdam’s sewer lines was completed in 2022 and remedies suggested, but no action was taken and no further work on this in the pipeline.

Comprehensive Plan Every municipality is strongly encouraged by funding agencies as well as the Office of the State Comptroller to have a comprehensive 10-year plan delineating its visions for the future. This document not only protects the municipality from legal challenges of ad hoc or capricious taxation, it also provides strong support for funding from agencies: If two municipalities submit equally compelling funding requests, the funding is likely to go to the one with an up-to-date comprehensive plan. Potsdam’s comprehensive plan expired in 2023 and while funding has been requested to have an outside agency oversee the generation of a new plan, no committee has been named to work with the Planning and Zoning committees to tackle the many preliminary tasks involved. Resident involvement here especially vital.

Sale of Municipal Hydrodams Potsdam’s return on investment on the hydroelectric facilities has been negative since 2008. To date, village tax payers have been required to cover the cost of a 20 year, $5 million loan for the west dam, as well as a 20 year $3 million loan on the east dam. The west dam is inoperative, after 5 years of service. The east dam works at close to optimal efficiency and generated $136,000 in credit last year while the total annual operating costs (including debt payments) of both hydrodams amounted to $490,000. Local property taxes paid for the difference. The sale of the hydrodam(s) is on hold: no discussions around this critical matter are occurring.

Pine St Arena The arena at Pine St is in bad shape and needs a complete overhaul. Funding requests for an Engineering Report have been submitted.

Other matters brought up during board meetings include: Reducing the village’s carbon footprint by making municipal buildings more energy efficient; Studying food waste recycling efforts; Filling empty storefronts downtown and on outer Market St; Isolating water use on the three campuses (SUNY, CU & CPH) so the village does not pay for water losses on those campuses; Rebuilding the retaining wall on Fall Island, among others. Public input welcomed on all matters, including new members for the village, zoning and planning boards as well as the eventual comprehensive plan committee…