M.M. Tirion

The promise of free energy and the independence that provides has powerful allure.

Potsdam’s first hydroelectric plant began operating 1926. Built on the eastern shore of the Raquette river, its wooden turbine could generate 125 kW of electric power, seemingly for free. After 45 years of service, this facility was decommissioned in 1971 as the plant’s operator closed the wooden gates, blocking the water’s flow to the turbine, one last time.

For several years the plant remained idle. But the energy crisis of the 1970’s prompted the village board to consider reactivating the dormant powerhouse. In 1976 they hired Rist-Frost Associates P.C. of Glens Falls, NY to design a new, more powerful plant in the same location. Even though the water’s fall-distance and the river’s flow-volume had not changed, the engineers assured officials that they could quintuple energy production. By installing two turbines instead of one and using massive blades on those turbines, the refurbished plant would be able to generate 800 kW. Rist-Frost projected a revenue of $360,000 the first year.

With the promise of an abundant, local and green energy supply, the village board approved bonding for $3 million for the design and construction of a renewed municipal hydrodam. And in 1983 a vastly redesigned East Dam powerhouse started generating electricity. Power generation, however, fell well below projections year after year: frustrated by their misleading promises, the village board filed suit against Rist-Frost in 1987. That same year, the board attempted to hire Adirondack Hydro Development Corporation to run its hydrodam operation, an effort derailed by then-Mayor Paul Claffey who firmly opposed a possible loss of revenue.

This second east dam hydroplant operated for three decades when in August of 2014 the gearbox of one turbine broke. Within 6 months, the second gearbox failed as well. Once again the plant lay idle, which was especially unfortunate as in December 2014 the village administrator had signed an expensive “remote net metering” contract with Niagara Mohawk that would have significantly increased the village income stream from generated power.

In an effort to restart operations therefore, village officials sent the broken gearboxes out for repairs locally. Those (costly) repairs worked for a week or two before both gearboxes failed “catastrophically”. This time the East Dam hydro plant would remain idle for nearly 6 years while repair plans and funding sources were sought.

In 2016 the village partnered with the New York Power Authority for a financial feasibility study for repairs and necessary overhauls, and received an initial estimate of $1.8 million for the work. By the time NYPA contracted with the village however, in January of 2020, the cost had risen to $4.2 million. By securing $1.0 million in grants, the village paid for the rest with a $3.1 million serial bond. The third iteration of the east dam hydroelectric plant returned to operation in June 2021. In an eerie repeat of an earlier era, village staff and board were once again dismayed to discover that the power generated after the multimillion dollar upgrade was 60% lower than projected. Village board and staff once again began examining options to spend further funds to boost production, discussions currently on-going.

Meanwhile, talk of a second hydroplant, on the opposite or western shore of the Raquette, surfaced since at least the early 1980’s when Rist-Frost Associates discussed that option in reports. In anticipation of a such plant, the village financed the replacement of the old wooden dam straddling Fall Island to the west bank with a concrete one in 1990. By 2001 the village obtained the rights to have a west dam hydroplant licensed by FERC, with energy produced to be sold on the open market.

In May 2007, the village board fatefully approved bonding for up to $3.5 million to construct the promised west dam powerplant. In June the board signed a contract for $1.4 million with Canadian Turbines of Burlington Ontario, for parts. Presumably to eliminate the cost of principle on an insured serial bond, the administration decided to pay Canadian Turbines and its CEO Richard Kuiper, cash. The fact that this company was being sued by the village of Bancroft, Ontario at the time did not dissuade the administration. As is now well known, Canadian Turbines did not deliver the paid-for parts and the village sued Richard Kuiper for compensation. As he failed to show for court appearances, a Canadian court ruled in favor of the village with a generous $6 million settlement. Unfortunately the village administrator was told by Canadian lawyers that there is “virtually nothing to get from the guy”. The village then paid a different supplier a second time for the same parts, draining its general fund. Once delivered, those parts were found to be defective and had to be replaced. When after many years all parts for the west dam powerplant were finally assembled, the result was described by one official as a chimaera with parts from every corner of the world.

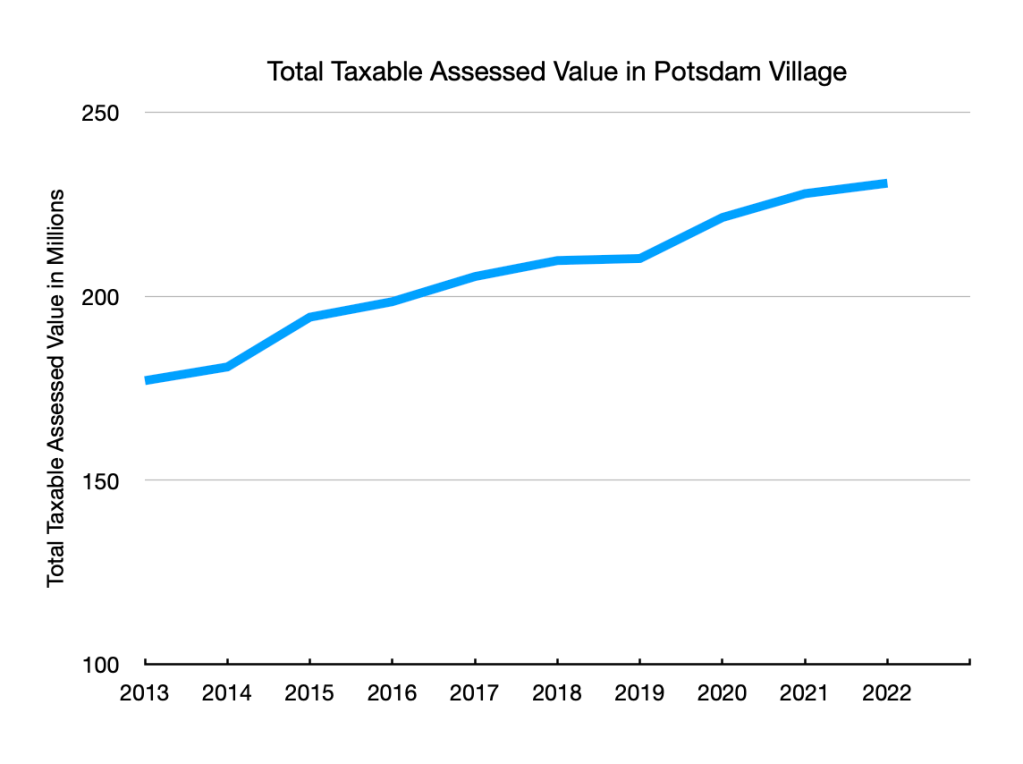

After seven tortuous years of uncertainties and delays and cost overruns, the west dam plant became operational in May 2014. The financial complications from the mis-investments did not end once the west dam plant was switched on however, as debt payments continued to drain the general fund. Village finances became even bleaker after the east dam plant stopped operating entirely in February 2015. Once again, actual income streams for the hydro fund were far lower than anticipated, and in March of that year the administration had to take out an emergency loan of $500,000 to pay village staff. In 2015 the NY Office of the State Comptroller designated the village as being under “Significant Fiscal Stress” and gave the village of Potsdam the dubious distinction of being the most fiscally stressed village in NYS.

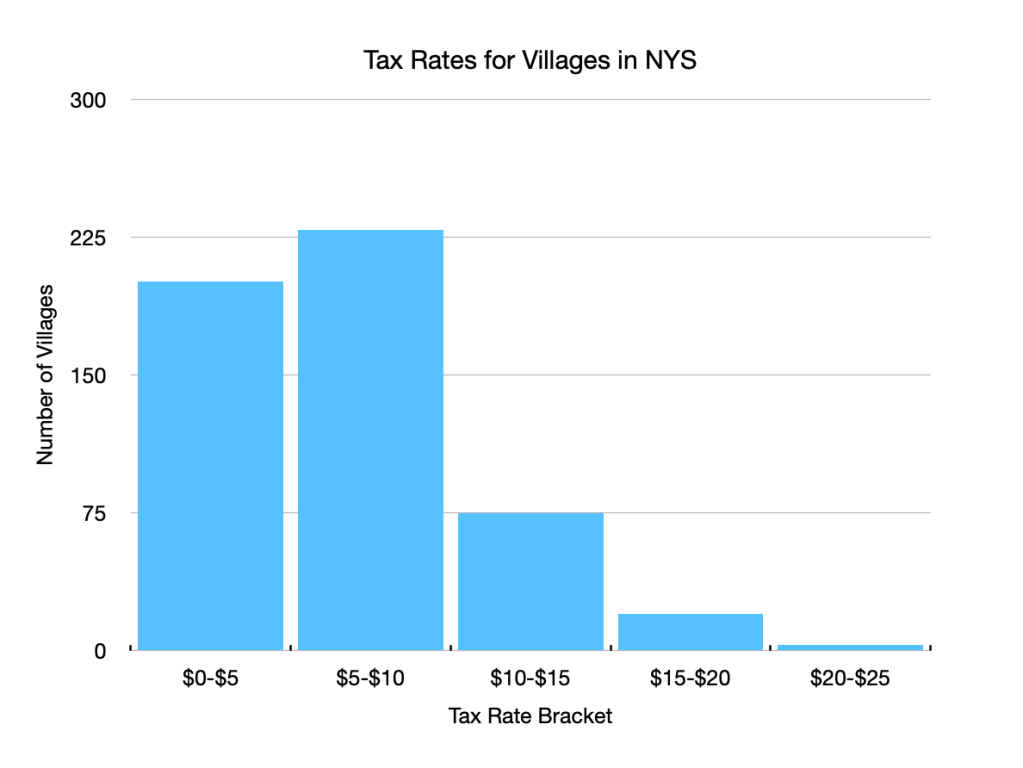

After restructuring its finances, including abolishing the village court and raising property taxes 32% from from 2013 to 2017, the village’s credit rating by Standard & Poor returned to a stable A. But then, a mere five years after the West Dam plant started generating power, instabilities in turbine design led to both its units breaking “catastrophically”. Figures are hard to come by, but one news article quotes an average monthly power production of $20,000 at the west dam plant. If so, during its truncated lifetime of 60 months, the west dam plant raised around $1.2 million of revenue for an investment far in excess of $5 million when design, construction, principle, law suits, operational and maintenance costs are summed. $1.8 million remains due on the west dam serial bond as we enter FY2023-2024.

The allure of free energy has cost the village dearly with each upgrade and repair. As in 1983, the newly refurbished east dam plant generates 40% of projected power. The west dam plant generated generous revenue due to a favorable remote net metering contract negotiated with Clarkson University, but has not generated any power since 2020 and will not do so, indefinitely. The village budget projects expenses of $560,544 to finance the municipal dams during FY2022-2023, of which $430,000 is towards debt payments. With a gross income stream at the east dam plant of perhaps $155,000 during calendar year 2022, the hydro fund likely must borrow on the order of $400,000 to pay its bills. The village has used general fund reserves to loan money to subsidize the hydro fund for years. General Municipal Law stipulates, however, that each fund be self-sufficient: the sale of generated power finances hydro operations; water and sewer fees finance operations of water and sewer plants; and property- and sales-taxes finance the general fund. It seems imprudent, unfair and possibly against Municipal Law that the village continues to use General Fund moneys to cover the costs of its municipal hydroplants.

Rather than invest more money into complex future upgrades and repairs in the hope that power production may one day match costs, I would like to see any number informed discussions first, including whether we may legally default on the west dam loan and cede ownership of that parcel? Or could we transfer operation of the two plants to professional hydroelectric engineers, such as Boralex Hydro Operations who operate the Sissonville Hydroelectric facility downstream? Is it time to invite the NYS Financial Restructuring Board for Local Governments (FRB) for financial guidance? Doing nothing or more of what hasn’t worked in the past seems inadvisable.