This week everyone is concerned about the new assessments: “Will my taxes double if my assessment doubled?” Or: “The notice indicates that my taxes are going down, even though my assessment went up? Is that correct?“

So how will the new assessments affect your future property taxes? Assessments of and by themselves cannot increase the taxes collected by any municipality (village, town, school and county). Only municipalities have the taxing authority to decide how much property owners will be required to pay. How does this play out?

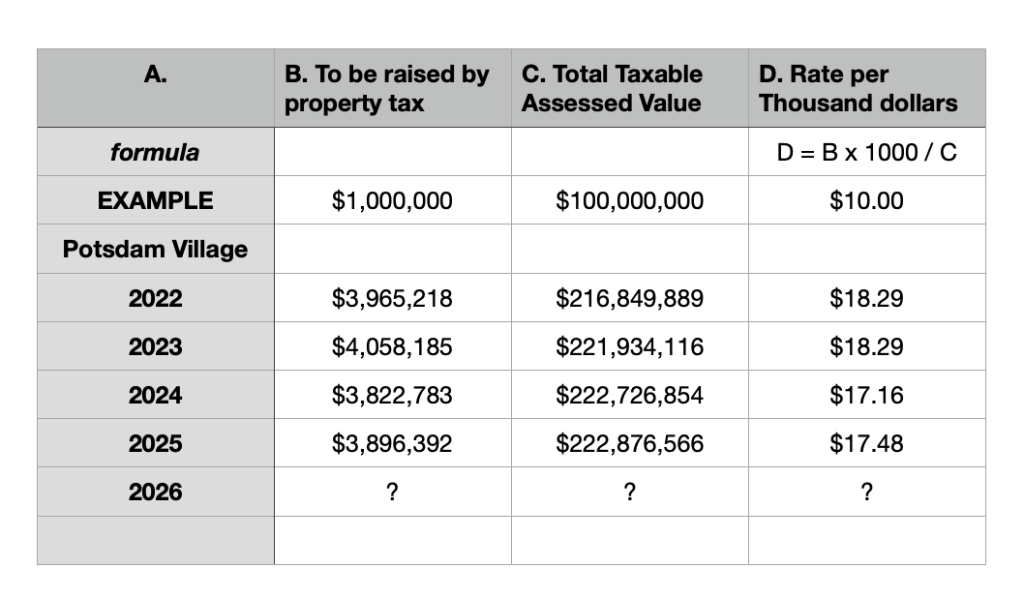

Let’s say a municipality needs to raise $1 million this year in order to run their operations. Let’s say the sum of all the taxable properties in that municipality comes to $100 million. As indicated in the EXAMPLE row in the first Table, the municipality would have to charge a tax Rate of $10 for every thousand dollars of property value in order to raise the required $1,000,000 levy.

How does this example compare to the actual numbers used by the village of Potsdam? Looking at the published village budgets found at: https://vi.potsdam.ny.us/category/news/budgets/ from 2022 through 2025, we see that the amount “To be raised by property tax” in the village has been around $4 million since 2022. The Total Taxable Assessed Value of all properties in the village was $217 million in 2022 and rose to $223 million by 2025; and the resultant tax rate went from $18.29 in 2022 to $17.48 in 2025. (This information is on the second-to-last page of each year’s budget document, under “Tax Rate Schedule”)

The assessment agency, using their new assessment information, and rightly trying to steer clear of any responsibility for future tax burdens, poses the simple question: “IF the levy imposed by your municipality stays the same ($1 million for example), WHILE the total taxable value went up to, say, $200 million dollars from $100 million, THEN the tax rate would have decreased to 1,000,000 * 1000 / 200,000,000 = $5 per thousand dollars of property value: i.e. halve as high as the previous rate when the total property value was $100 million. Using that hypothetical, the assessment agency then multiplied your actual new property value by this new hypothetical rate to give you an ESTIMATE of how your tax burden would have changed from last year’s. At best, this gives a sense of whether your property value increased more or less than the average.

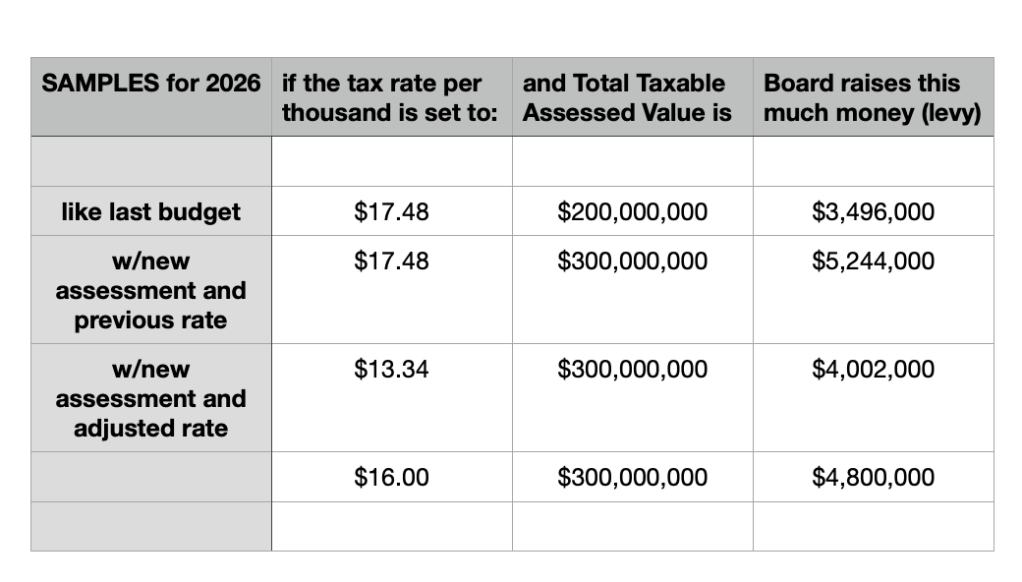

What options exist for the village board as they construct the new budget due June 1, 2025? In the second Table, I illustrate with a few extreme examples. Everything depends on the new Total Taxable Assessed Value, a value that has not yet been made public (though I did not try to ask the Town’s assessor for this value; it will be available once the village board decides to release the new “Preliminary” budget document. It will also be published by the county government at stlawco.gov under Tax Rolls for 2026). For the sake of a concrete example, let’s say the new total assessed value rises from around $200 million to $300 million. If the village board keeps the same tax rate as last year’s, i.e. of $17.48 per thousand dollars of property value, then they would raise a whopping $5.2 million instead of $3.5 million. That might be fun for the village board and staff, but obviously that would double the tax burden on everyone. At the other extreme, if the board decides to requisition the same levy as always, around $4 million, THEN the tax rate would decrease to $13.34 per thousand dollars of property value. Most municipalities compromise: lower the tax rate a bit, perhaps to $16.00/thousand in this example, and thereby still increase the levy significantly, from $3.5 million to $4.8 million. In sum, it is not the tax rate nor the assessments that determine your tax burden, but the LEVY that the municipality imposes.

So under the header “caveat emptor,” it behooves everyone to keep a close eye on the “Amount to be Raised by Tax” column of the Preliminary budget document that should be made public any day now. As indicated, the village has requisitioned around $4 million each year since 2022. NY state law requires that municipalities not increase their annual levy by more than 2%. Unfortunately, this law may be overwritten by a simple agenda resolution. Such a resolution is on the village board’s agenda for Monday April 7, 2025 at 5:45pm: at that time the public is invited to provide comments to the board about the board’s intention to override the state’s tax levy limit.

By simply asking “What amount of money is to be raised by property taxes next year?” And “How does that compare with last year’s $3.9 million?” And if the levy is set to increase by more than 2%, then ask: “Why is that?” Everyone should be on board in developing a fair and equitable village budget.