While the Potsdam Village Board of Trustees busied itself with Ives Park projects and parking matters, I wondered what the village’s department heads considered high priority projects? Thanks to “Village Department Head Surveys” completed last year as part of the 2023-2033 Comprehensive Planning Process, residents can learn which tasks our department heads consider vital for the village. I report here primarily on the most cost-heavy items.

The head of the Hydro Plant lists as the first item: Sell the west dam. The west hydrodam was meant to cost $3.5m and to begin operations in 2009 for 30 years. Instead it required $5.5m in loans, began operations in 2015, and ran for merely 5 years. The two municipal hydrodams together require around $120,000/year to operate and maintain. In addition, there are the debt payments: the West dam debt payment is $265,000 annually, until 2029. The East dam debt payment is $115,000 annually, until 2046. The operating east dam meanwhile generated $136,201 in credit last fiscal year, leaving an annual deficit of $455,544 that continues to be paid from the tax-payer’s General Fund.

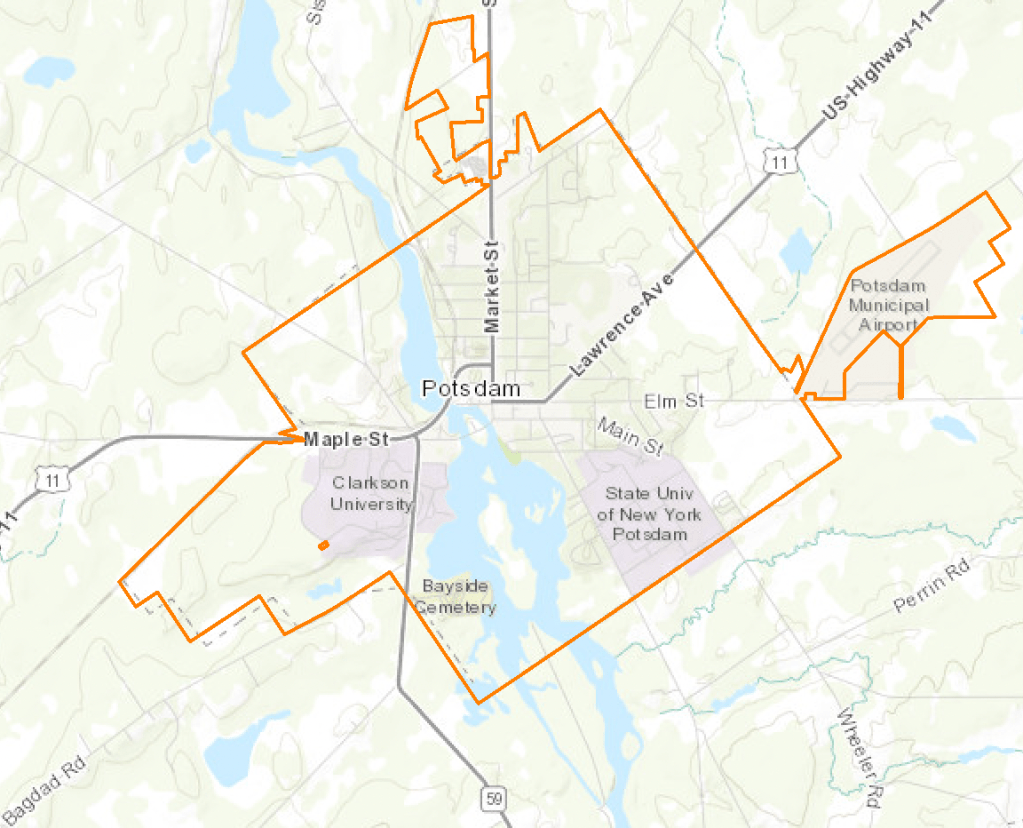

The head of the Water Treatment Plant (WTP) lists 13 capital projects and equipment needs required to ensure the continued operation of the WTP, to the rising purification standards set by State and federal laws…and to prevent the roof from leaking (The water treatment plant on Raymond St dates from 1983 so is over 40 years old). I understand that this update/upgrade will be as expensive as the sewer plant update of 2020.

The head of Planning & Development states “Village infrastructure will be the single largest challenge for the next decade and beyond. Water and sewer lines, the cross town canal, underwater sewer lines and new federal standards for drinking water/waste water will only add to the cost and complexity of the Village’s systems…The Village needs to focus its efforts on infrastructure, preparing engineering studies so that it is prepared to annually apply for funding…An engineering study for the tail race wall at Evans & White needs to be commissioned. The wall is in poor condition and may be undermined given water bubbling up under pressure from Evan’s parking lot…”

The head of the Recreation Department writes that the expansion and remodeling of Pine Street Arena is a high priority goal.

The head of the Sewer Department (aka the Waste Water Treatment Plant or WWTP) does not report urgent needs at that plant thanks to the complete recent rebuild of the WWTP, a rebuild that required a $12m loan that will be paid off in 2051. (While there are no operation issues here, the head of the WWTP points to the fact that one high-expense item at any waste water treatment plant is power consumption, and that technology exists to extract energy from the heat and gasses generated during waste water treatment. Incorporating such technology at our WWTP would reduce expenses and waste.)

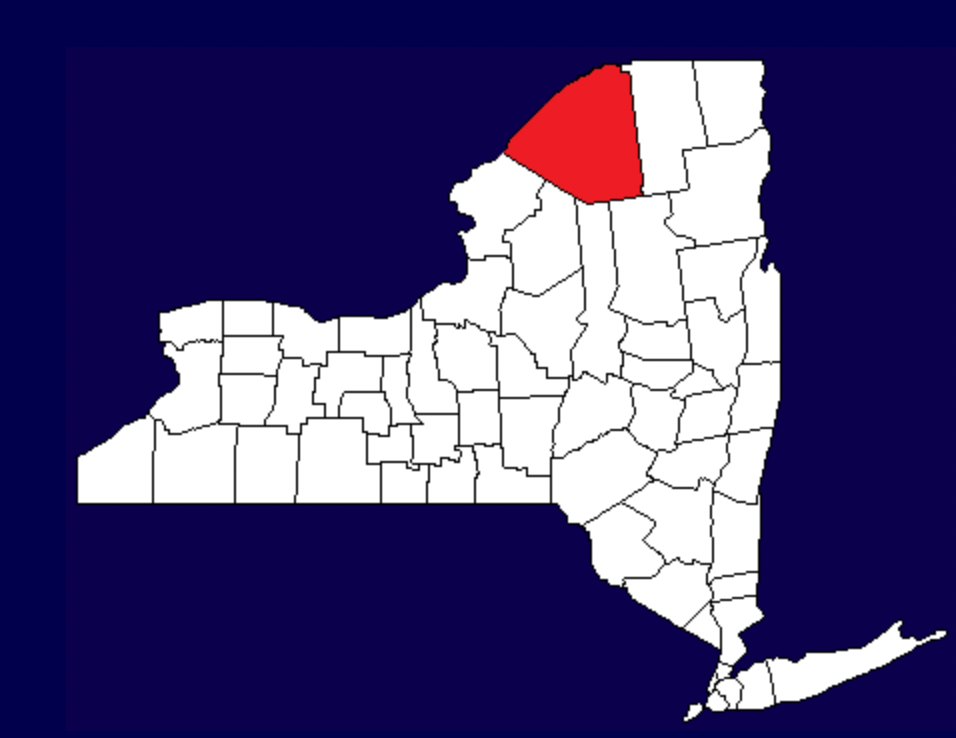

Between the water treatment plant on Raymond St. and the sewer plant on Lower Cherry St. run about 30 miles of underground water and sewer piping as well as the various ditches and channels that constitute our storm-drain system, all of which is purview of the Department of Public Works or DPW. While maintaining streets, picking up brush, clearing fallen trees and snow etc, DPW also monitors the operation of all sewer and water mains as well as the cross town canal. DPW also deals with random challenges and crises, from beaver-dam breaks that inundate properties on the western shores of the Raquette river, to tiled fields to the east that direct massive inflows of stormwater into our cross town canal drainage system. In addition, two cross-river sewer lines “have reached the end of their useful lives and need to be replaced” according to a 2022 Engineering Report entitled Inflow and Infiltration Study prepared for the Village of Potsdam by the firm EDR. This report additionally details how and where leaks enter the sewer lines during rainstorms, and quantifies which below-ground pipes must be lined. The challenges DPW is tasked to resolve, in other words, are many, diverse and complex, and may not have obvious resolutions in some cases.

The heads of other departments (Police; Clerk/Registrar; Treasurer/Administrator; Fire; Safety/Code Enforcement; Museum) either had not yet filed survey reports or did not report urgent and high-cost Capital Outlay/Equipment needs.

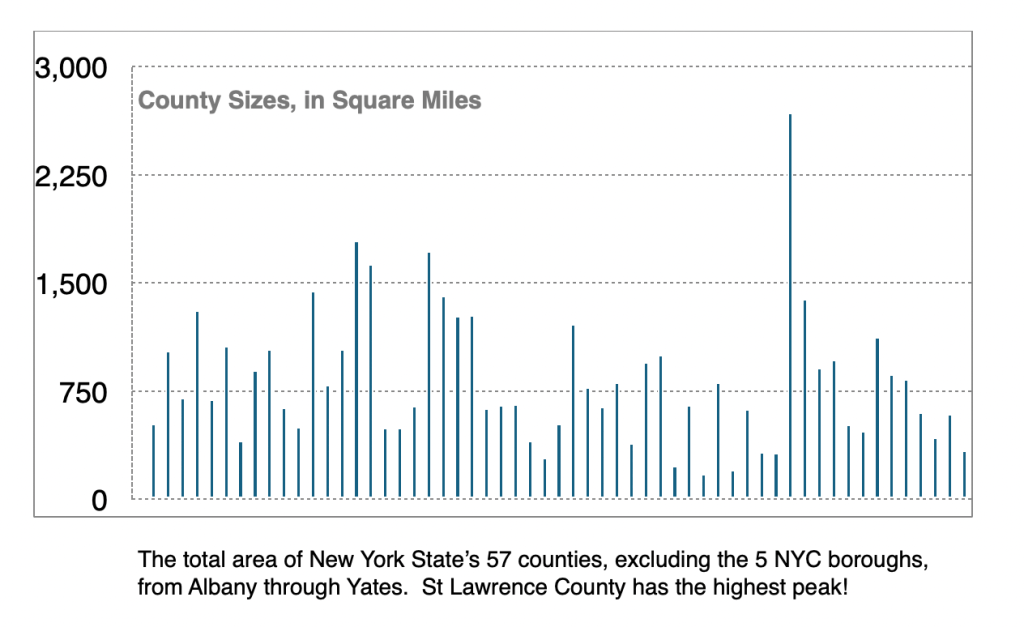

Infrastructure repairs and construction bear high costs: The EDR Inflow and Infiltration Report, for example, quoted a cost of $9.3m to replace the aging cross-river sewer pipes and to line all leaking underground sewer pipes. For context, the current tax rate in the village is $17.48 per thousand dollars of property value. If the Board had been tasked to raise an additional $1m from property taxes this fiscal year, we would have had to raise the tax rate to $21.97 per thousand dollars of property value. For a home worth $150,000, that would have represented an increase from $2,622 to $3,296, an additional 673 dollars.

Department heads run their respective departments efficiently and effectively. They will continue to work with the Administration to ensure the continued operation of every aspect of infrastructure and services, and will resolve each issue/crisis as it arises. Getting Trustees up to speed on the many gnarly issues that each department faces would benefit everyone-so that realistic budgets for the next budget year as well as upcoming budget years may be developed. But reports such as these Department Head Surveys are not generally distributed to Trustees: it took weeks, if not months of repeated requests to obtain copies of these reports. Likewise, it was by chance that this Trustee obtained a copy of the 2022 EDR Engineering Report that provides hugely helpful insights into the why, where and how costly is the inflow/infiltration problem facing the sewer lines, a report that should have been front and center in the hands of every Trustee.

Why is it so difficult to share information? Is it unwise for residents to be aware that the wall abutting Evans & White is crumbling and may give way? Why should Trustees not read a village-funded EDR Engineering Report-while we were yes asked to approve a seemingly competing “Raquette River Utility Crossing Project”? It is deeply frustrating that the Village Board of Trustees are informed of developments only after all groundwork is complete, all pertinent decisions have been made, and all boundary conditions laid down – Trustees are requested to approve only the final budgeting. The frustration arises as many questions appear not to be asked and many angles appear not to be considered, increasing the likelihood of unproductive and costly dead-ends, like the West Dam. Does the administration believe that questions and open discussions imperil rather than strengthen the chances of a projects’s success?