In the previous posts we discussed the Water and Sewer tax/fee rates and reported that the rates adopted by the Treasury department do not match the stated Appropriation requests. The rates quoted in the budget report will bring the Treasury a combined $400,000 excess revenue. Unfortunately, I cannot find an updated, corrected Budget document.

In another post, we discussed how the Hydro Fund expenses are almost completely borne by local property tax dollars, in violation of the “Less Non-property Tax Estimated Revenues” column on page 30 of the budget report.

Before commenting on the proposed General Fund portion of the Mayor’s budget, I had hoped to hear the Mayor’s comments, as that important document is full of pain and promise. Unfortunately, I was unable to access the village board’s live-stream of the board meeting last night, and have seen no written comments by anyone in the administration on why the General Fund appropriation ballooned this year.

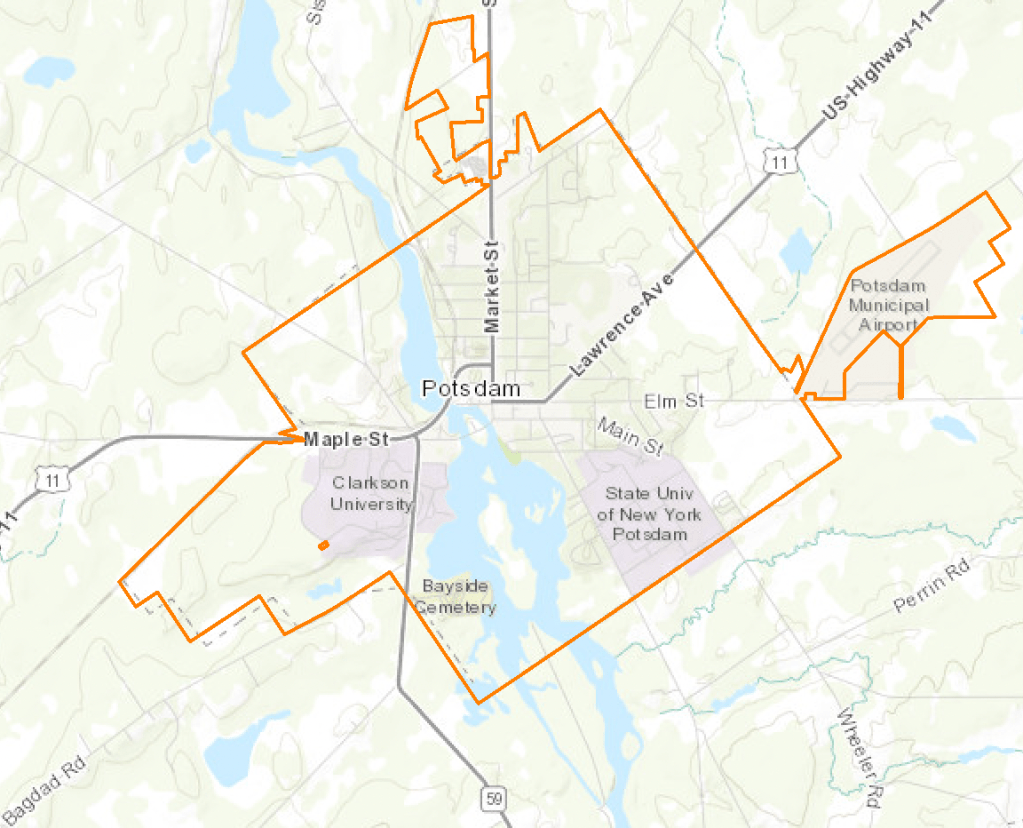

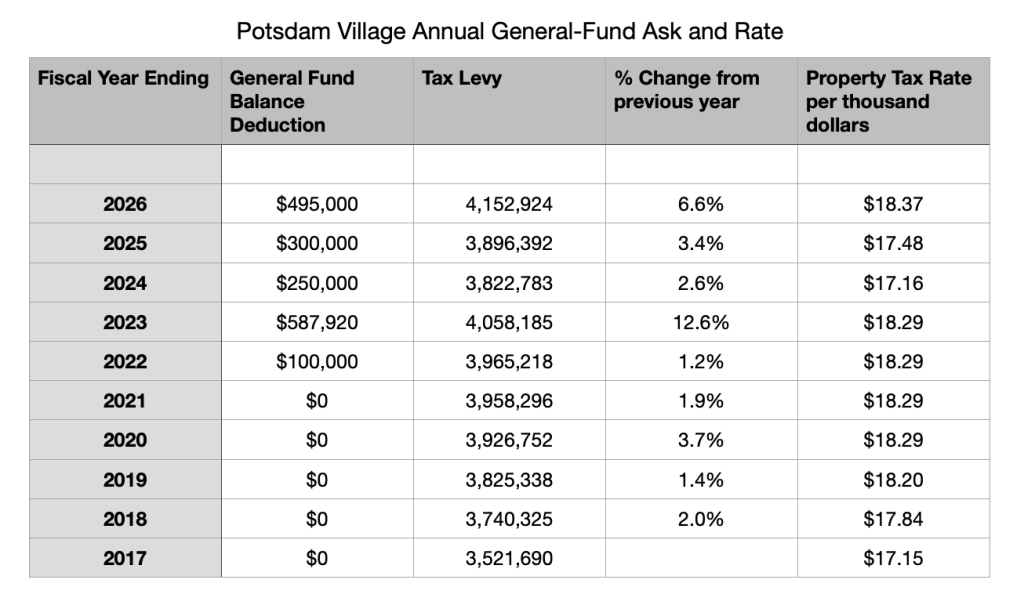

For the sake of historical context, I therefore post two data sets today. The first lists the Tax Levies by village boards for fiscal years dating back to 2017. Note that before 2021, Village Boards did not withdraw funds from any “left-over” moneys (General Fund Balance Deduction) remaining in the fund balance at the end of each fiscal year. The Covid pandemic changed this habit, with boards dipping into village savings accounts to cover expenses.

Note that the tax rate stayed steady at $18.29 for many years. During my time on the board, I urged the board to lower the tax rate in 2024, as we were clearly receiving more revenue than appropriations required. That brief respite was immediately turned around, and this year, the Village of Potsdam proposes to charge the highest tax rate it has ever charged! $18.37 per thousand dollars in property value! This in spite of the fact that they will take half a million dollars out of savings to lower the levy! And that huge savings-withdrawal, in spite of not knowing the actual amount in savings. (The promised external audit reports for the past few years did not arrive, and our Treasury cannot ascertain how much of the moneys in our investment account has already been committed to the many projects that are underway.)

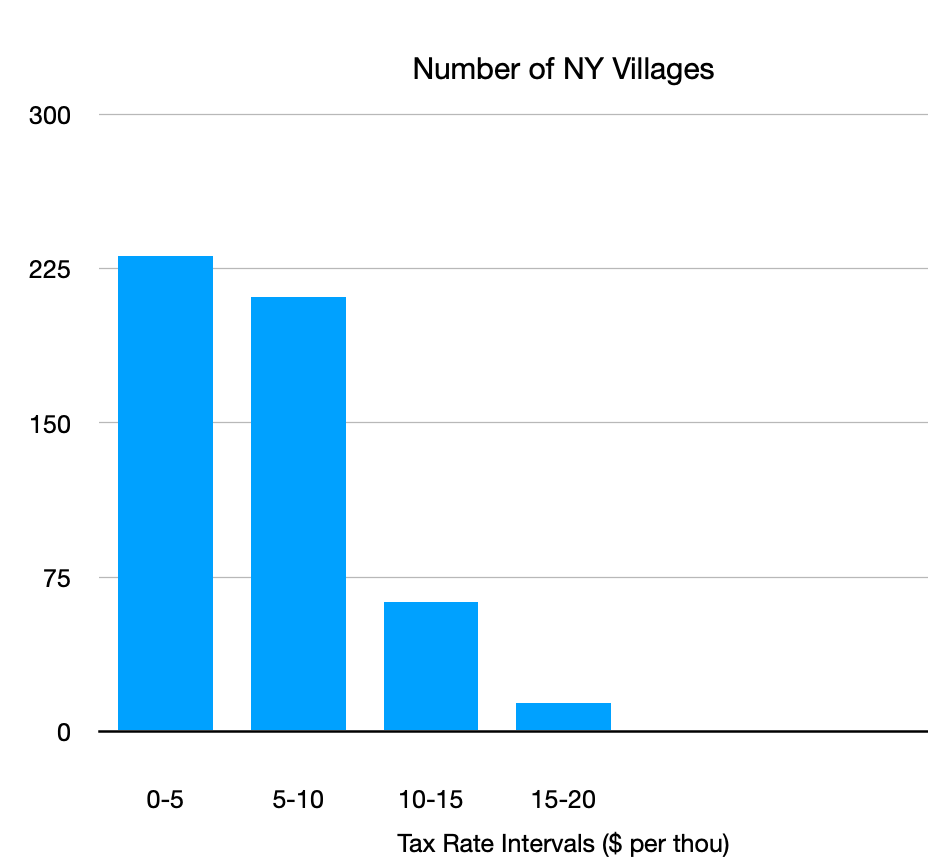

Looking at the latest (2024) published tax rates across all villages in the State we see that our municipality will have the dubious distinction of having the second highest tax rate of any of the 520 villages in NYS. Only Herkimer in Herkimer County pays a higher tax rate, at $18.61. The average tax rate across all villages in the state, in 2024, was $6.14. Ours is almost exactly three times higher than the State average. To see where we stand relative to other villages, I plot a histogram of tax-rates binned in $5 dollar intervals; so for example, in 2024, 231 villages had tax rates under $5.00, and merely 14 villages had tax rates over $15.00. Potsdam’s is right up there, almost at the top.

In the interest of full disclosure I must report one indiscretion: the phrase “our municipality” will no longer apply to me after today. Today, we closed on our beautiful village home of the past 3 decades, and have moved downstate to be close to family. I have requested access to any external Audit report(s) that might come out, and would be happy to comment on those reports, in view of the grim finances implied by the current budget document. I hope to continue hearing from many of you and also hope to enjoy visits from and to you. Best to all.