The news recently reported that the Potsdam Town Assessor will re-assess the property values of all parcels in the Town of Potsdam, including all Village properties. This is the first re-assessment since 2013. What will happen to our property taxes next year, when the new assessments go into effect? (The new assessments will not affect the tax rate for the upcoming budget year of 2024-2025)

Currently, the village’s Total Taxable Assessed Value is $220 million. My home, for example, has a taxable assessed value of $142,000 (less than its Full Market Value of $169,000 due to tax benefits like STAR). The village property tax-rate is currently set at $17.16 per thousand dollars in property value, so I pay 17.16 x 169 = $2,436.72 in village taxes on my home.

What happens if my home is re-assessed with a 40% increase in its taxable assessed value, from $142,000 to $199,000? Will I end up paying 40% more property taxes: $3,411.41 instead of $2,436.72? This should definitely not happen, under any circumstances. Re-assessments are village-wide, and all properties that have not recently been sold, like mine, will get their Full Market Value re-appraised. (Full Market Values are updated to the sale price of properties on the date of sale.) The upcoming re-assessments might increase the village’s Total Taxable Assessed Value from $220 million to perhaps $320 million (I have zero idea how great the increase will be, this value is merely to demonstrate the process.)

If the re-assessment, including the grievance period, completes before April of 2025, as it is meant to, then the new assessments will dictate the village tax rates starting with budget year 2025-2026. If expenses remain level, for the sake of argument, and the amount of revenue that must be derived from property taxes doesn’t change, but the Total Taxable Assessed Value goes from the current $220 million to $320 million, then the property tax rate would decrease from the current $17.16 per thousand dollars in property value to $11.80 per thousand dollars. That in turn would mean that my current property tax levy of $2,436.72 on my $142,000 home would go to $2,348.2 on my $199,000 home, a slight decrease.

But of course expenses never remain level, and the temptation is great to both lower the tax rate a bit…but not all the way…so as to simultaneously increase the tax levy. So it will be super important to not only keep an eye on the updated assessed values, but equally important to keep an eye on the total Property Tax Levy that the village Board will impose next year. It should not suddenly increase, as this chart makes clear.

As an aside: The Property Tax Levy for the current fiscal year can be located on the village website: https://vi.potsdam.ny.us/category/news/budgets/ Click on Final 2023-2024 Budget. Scroll through to the last page of the document, and you will find the Tax Rate Schedule page for the 2023-2024 tax year. Similar documents for the Tax Rate Schedules of earlier budget years should exist on the village website, but I could not locate them (only truncated budget reports, without Tax Rate Schedule pages). Please visit or call the Clerk or Village Treasurer at 265-7480 for the Tax Rate Schedule for other fiscal years.

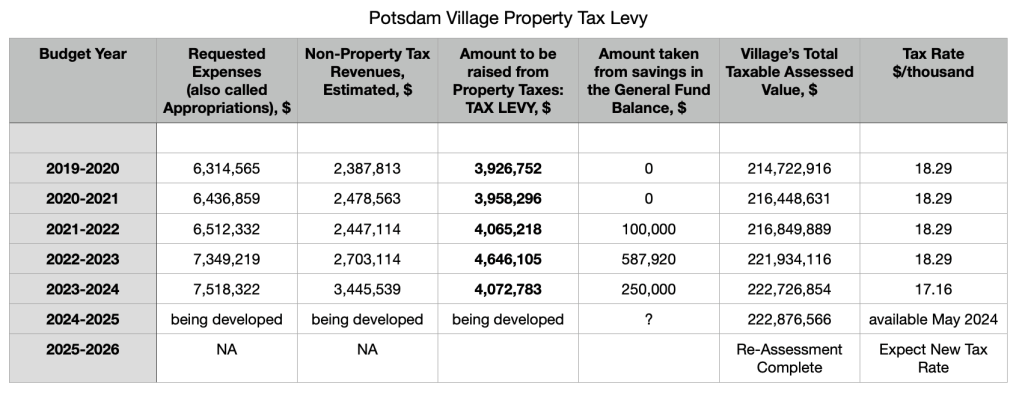

Continuing: The chart shows for each of the last 5 budget years the total amount of money requested by the General Fund (“Appropriations”); the estimated non-property tax revenues (including sales tax revenue and building permit revenues etc); and the tax levy, or the amount of money that must be raised by property taxes: this is equal to Requested Expenses minus Non-Property tax Revenue, and has mostly remained close to $4 million per year.

As you see, in some years (especially 2022-2023) the tax levy got too big, and the administration decided to pull sufficient money out of savings to keep the tax rate stable at $18.29 per thousand dollars of property tax. (Last year $250,000 was pulled from savings in order to lower the tax rate to $17.16 per thousand dollars.)

In summary: To determine whether our taxes will change as a result of the upcoming property reassessments, it will be important to keep an eye on the updated property Full Market Values / Taxable Assessed Values, but it will be equally important (if not more important) to keep an eye on the total Property Tax Levy that the village Board will impose next year: The tax levy over the past 5 years has remained around $4,000,000 and should not suddenly rise to $4,500,000 for example.

Have you ever paid less in property taxes? I know I haven’t. Every level of local government and the state have seen rapid increases in every line item. Hold on to your hat…or move out of the state. We’re on a sinking ship.

LikeLike

From 2018 through 2023 we paid $18.29 per thousand dollars in property value ($1,829.00 on a $100,000 house); while this year, in 2024, we paid $17.16 per thousand ($1,716.00 on a $100,000 house), a decrease of $113.10 on every $100,000 in property value. With effort I do believe we can reduce the local tax rates to be closer to regional and state averages.

LikeLike